Presentation of Esso S.A.F.

Now North Atlantic Energies

Esso Fair Value aims to provide shareholders with clear, structured, and accessible information about the sale of Esso S.A.F. and the main valuation issues. The platform is updated as official publications and new information become available, so that everyone can follow the progress of the case with complete transparency.

General shareholder information is published on the North Atlantic website: northatlantic.fr/actionnaires

Context

Esso S.A.F., now renamed North Atlantic Energies since November 28, 2025, was historically a subsidiary of the ExxonMobil group, active in refining, logistics and marketing of petroleum products on the national market.

Following the announcement of May 28, 2025 and the completion of the transaction on November 28, 2025, the company is entering a new stage in its history:

- change of controlling shareholder,

- implementation of long-term agreements with entities linked to ExxonMobil,

- and continuation of its activities with French customers.

Heritage and Assets

Esso S.A.F. has supported the supply of the French market with fuels and petroleum products for over a century. It relies on:

- An essential market share representing 30% before the Fos/Mer sale and 20% since,

- industrial and logistics assets located on the territory and a unique geographical position in Port Jerome.

- long-term supply contracts,

- a wide distribution network operating notably under the Esso brand which will be retained.

- and a set of minority shareholdings in companies necessary for its operation.

Gravenchon Refinery

The Gravenchon refinery is operated by Esso S.A.F., now a subsidiary of North Atlantic.

Semi-annual financial report of Esso S.A.F.

Financial report as of June 30, 2025 detailing the company's activities and performance.

Announcement of the Transfer of Esso S.A.F.

On May 28, 2025, ExxonMobil announced that it had entered into exclusive negotiations with North Atlantic France SAS for the transfer of its controlling block in the capital of Esso S.A.F. (and, separately, of ExxonMobil Chemical France).

Following this transfer, North Atlantic France SAS will have to file a mandatory public offer on the remaining shares of Esso S.A.F., the launch of which is expected at the beginning of 2026, in accordance with the press releases published on May 28.

Depending on its outcome, the offer could be followed by a mandatory buyout resulting in the delisting of Esso S.A.F. shares.

The transaction has since been completed: on November 28, 2025, ExxonMobil France Holding declared that it had transferred all of its shares, marking the change of control and the company's new name under North Atlantic Energies.

Esso S.A.F. Share Price and Trading Volume Evolution

Esso Share Price

Evolution of Esso S.A.F. share price over ten years.

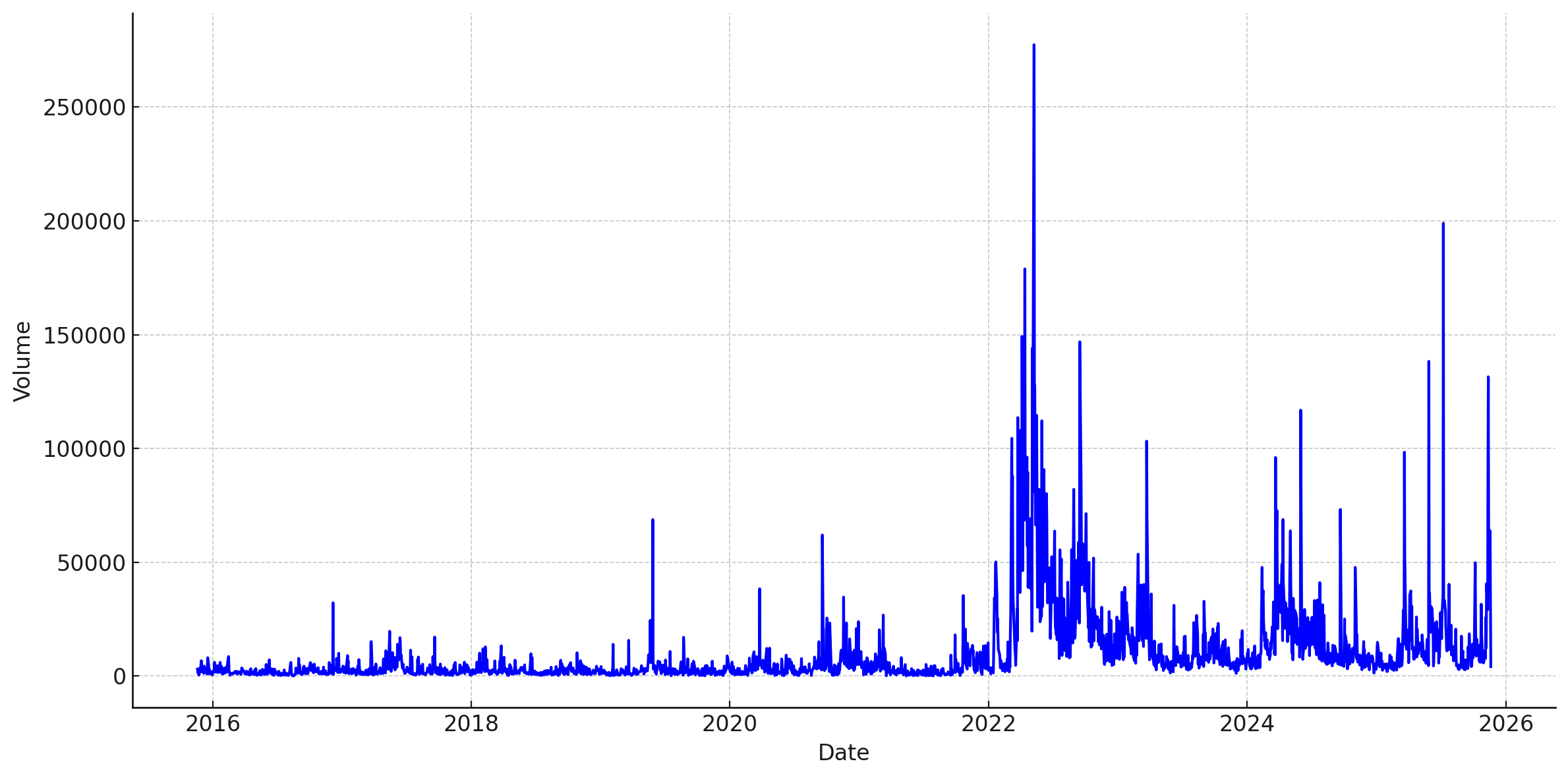

Trading Volume

Evolution of Esso S.A.F. share trading volumes.

The evolution of Esso S.A.F.'s share price over ten years shows a long-stable stock before strong volatility starting in 2022, a period marked by the energy crisis and soaring refining margins. Trading volumes then experienced an initial historic peak.

Since 2024, volumes have tightened again and price movements have intensified, linked to successive announcements regarding the sale, exceptional distributions, and price adjustments communicated by North Atlantic. The acceleration of volatility in 2024–2025 reflects a market seeking visibility on industrial prospects and the offer price.

The Operation at a Glance

The exclusive negotiations announced on May 28, 2025 resulted in the transfer, on November 28, 2025, of 82.89% of Esso S.A.F.'s capital as well as the entire capital of ExxonMobil Chemical France (EMCF) to the North Atlantic group. EMCF is ExxonMobil's petrochemical subsidiary in France, operating notably the Gravenchon/Port-Jérôme industrial site in Normandy.

In accordance with regulations, North Atlantic must file a mandatory public offer on the remaining Esso S.A.F. shares not held following the acquisition. The acquirer has indicated that this offer is expected to be filed in the first quarter of 2026.

Press Release of May 28, 2025

Screenshot of the official press release announcing the operation.

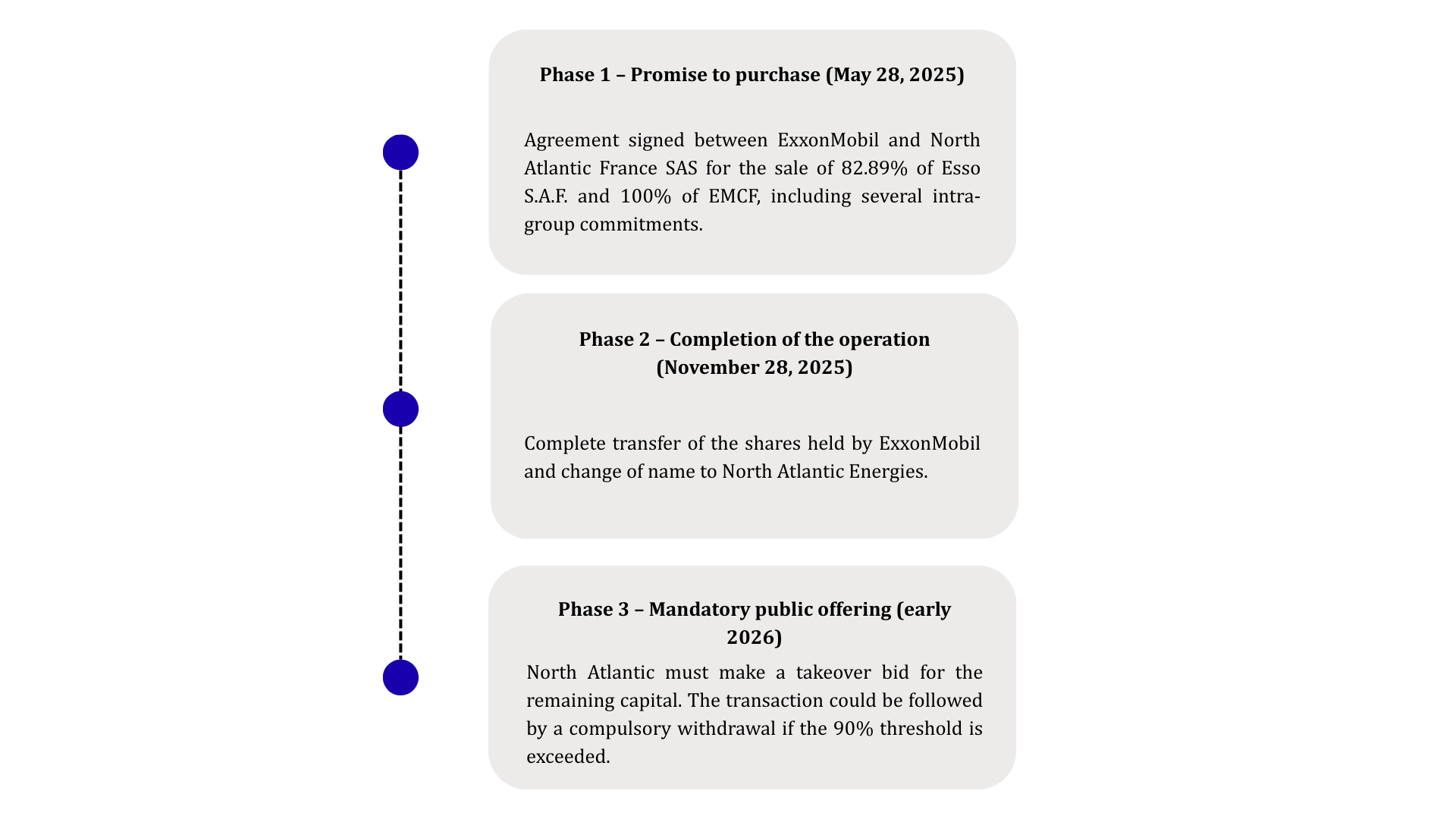

How the operation is structured:

- Phase 1 - Purchase promise and negotiations (May 28, 2025)

Signing of an agreement between ExxonMobil and North Atlantic France SAS for the transfer of 82.89% of Esso S.A.F. and 100% of ExxonMobil Chemical France, accompanied by intra-group commitments (supply, brands, logistics contracts). - Phase 2 - Completion of the transaction (Closing on November 28, 2025)

All conditions precedent have been met:- social consultations

- regulatory authorizations

- financing

- Phase 3 - Mandatory public offer (early 2026)

North Atlantic France SAS must now file a mandatory public offer on the remaining capital, in accordance with the French Monetary and Financial Code.

The indicative price communicated at closing states:- €26.19 per share for the block acquisition,

- €28.93 per share for minority shareholders as part of the tender offer.

Operation Timeline

Chronological timeline detailing the key stages of the transfer operation.